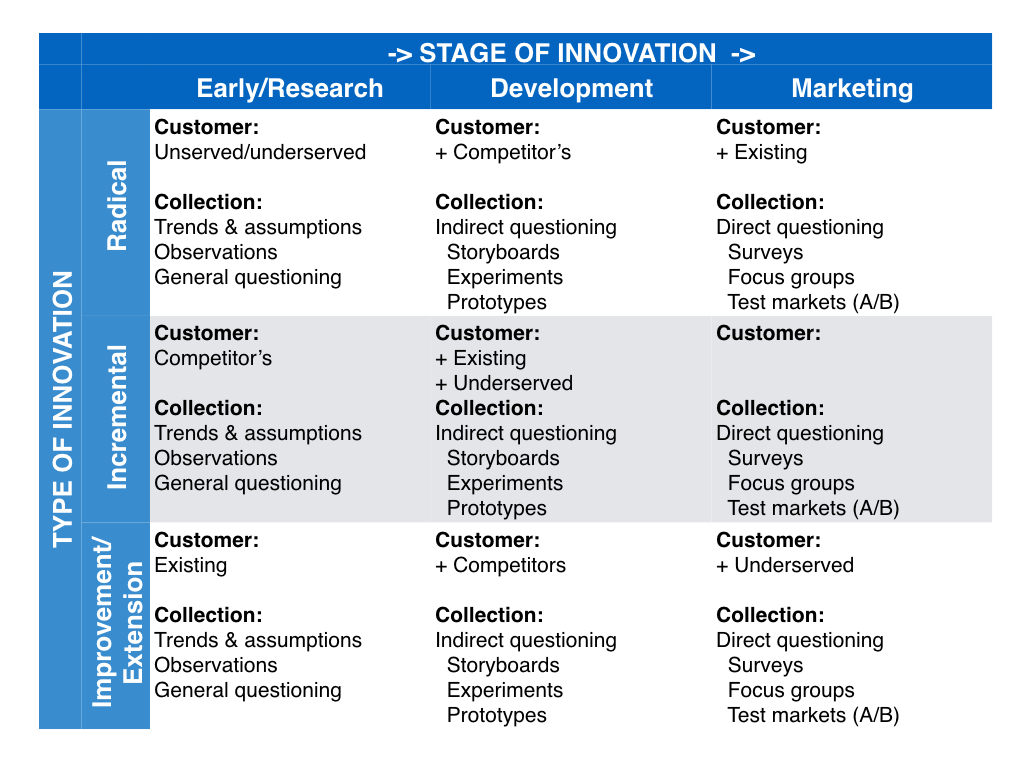

“If I’d asked my customers what they wanted, they’d have said ‘a faster horse’.” Henry Ford (attributed), developer of the Model T car (1908) “What incredible benefits can we give to the customer?” Steve Jobs, co-founder of Apple Obtaining and understanding the needs of your customers is a critical activity. It’s also one that needs to be undertaken on an ongoing basis. The Voice of the Customer (VOC) is the term often used to describe the results of these activities. Understanding your customers’ needs, wants and their “jobs-to-be-done,” provides your firm with the vital information needed to be positioned to deliver value to them. Ole Kirk Christiansen’s company began making wooden toys in 19321,2. By watching children play as well as taking the progressive step of actually talking directly to children about their desires, he learned that they liked the tactile feel of wooden blocks as well as their ability to be stacked. He also learned that children liked coloured toys, and that they frequently put their toys in their mouths (which especially in the case of wood could be unhygienic). As a result in 1949, he successfully commercialized plastic Lego bricks to address these issues. Further observing the frustration that children experienced when their Lego (or wood) structures collapsed, his son Godtfred led the development and commercialization in 1963, of the modern Lego brick with its strong interlocking ability. As a result, the Lego Group has experienced significant commercial success. Lego is the world’s largest toymaker with current annual revenues in excess of $2 billion. This brief Lego case illustrates the importance of VOC. The difficult comes in obtaining an accurate VOC upon which to guide the development of your next product, service or business model. An effective process needs to be tailored to the stage of the offering’s development: early/research, development or marketing. In addition, researching a radical innovation must be carried out differently from an incremental one and likewise for a basic improvement or extension. Nevertheless, each processes requires you to define your customer segment or segments, decide on the means to obtain the information, analyze the resulting information, and finally determine next steps. Failure to align the information gathering process with the offering’s stage can result in the collection of poor and unactionable, or worse - misleading information. There are two frequently referenced quotes, one attributed to Henry Ford, “If I’d asked my customers what they wanted, they’d have said ‘a faster horse’” as well as one by Steve Jobs, “It's really hard to design products by focus groups. A lot of times, people don't know what they want until you show it to them.” Both these famous and successful entrepreneurs have been understood my many to be implying that VOC research is a waste of time. In fact, both men were very customer focused, always looking for ways to deliver more value as Ford achieved with his simple but high quality and affordable cars, and Jobs achieved with his user-friendly computer devices, software and interfaces. The underlying truth in these quotes is that these men are referencing analyses and methodologies that are not suited for opportunities in the early, radical innovation stage that they each found themselves in and hence do not yield actionable information. Analyzing these quotes in more detail, one could argue that Ford recognized a customer desire: more speed, and Jobs the value of prototypes! At the initial phase of the innovation process, you will either have an initial idea or technology (push), have recognized a challenge or opportunity (pull), or more likely some contribution of both. You will also have some idea as to whether the solution involves a disruptive, a radical, an incremental or an improvement/extension level of innovation. Your first step is to define who the customer or customers might or could be as a guide to whom you will observe and question. Radical and even more extreme disruptive innovations involve something completely new that current offerings do not address. As a result, they tend to interest the unserved or at least underserved customer and create new markets. TV, personal computers, digital photography, word-processing, cellphones, wikipedia, plastic and automobiles are all examples. Incremental innovations, on the other hand, help capture market share by providing significantly more value to a competitor’s existing customers. HDTV, laptops, smartphones and their associated cameras, Google and anti-lock brakes are all examples. Finally, improvements and extensions provide additional value to your existing customers which maintains their loyalty. Upgraded features, options, styling and broader choices like larger TV, computer and smartphone screens, higher resolution cameras, Google scholar and patents, and intermittent windshield wipers can be considered examples. (See the Table) At the early/research stage, it is important to explore the potential of your offering in a very abstract way. Exploring and examining the industry’s trends and underlying product, service and business model assumptions is a good start. Experts as well as individuals far removed from the industry can provide valuable insights from their very different perspectives. Questions that explore why things are the way they are or how they evolved to the current state can be enlightening. Carefully observing how your and the competitors’ customers address the “job-to-be-done,” also termed anthropology can also be revealing. You need to analyze what the underlying or core job-to-be-done is, what choices are available, and why the observed choices are made. Finally, general questioning of the appropriate customer group should be undertaken. Open questions such as: “What reduces your productivity?” “What pains or angers you?” “If you had 3 wishes, what would they be?” can all assist you in getting to the core needs and wants of the customer. To reiterate, the goal at this early stage is to obtain as broad and unbiased a view as possible of customer’s feelings and needs, and not to test your own idea of the solution. As the new offering moves into the development stage, not only does the means of collecting information change, but additional customer groups need to be added depending on the type of innovation (See the Table). The additional information collected may allow a tweaking of the offering in order to address a larger market. For example, in the case of a radical innovation the customers of competitors should be added to the mix as they are currently satisfied, but may have unaddressed concerns. At this stage, you are ready to add some focus to the questioning. Initially developing simple and then more detailed storyboards and/or prototypes that outline the basic features and functions as a means to demonstrate the benefits and overall value, provide a vehicle for productive discussions to refine your understanding of the customer needs. Simple experiments designed to explore the various components or aspects of your offering, such as size, weight, material, speed, complexity, and/or user-friendliness are also appropriate. At this development phase, issues of price, cost to manufacture and even technical feasibility should be minimized so as not to overly bias the research process. As the questioning gets more specific, the sample size needs to get larger in order to ensure statistical significance. Again, care must be taken to ask indirect questions as this VOC process is designed to collect information, not sell preconceived ideas. Especially during this phase, you must be careful not to “invent in front of the customer.” If instead of asking questions, as to likes and dislikes, you and your customer start to brainstorm features together, your customer may have a legitimate and legal claim to be a co-inventor on a future patent filing! Finally, as the new offering approaches the market stage, more detail, specific and formal information collection from an even larger sample size, representing a broader range of customer groups is desirable (See the Table). At this stage, later versions of the offering could be tested in-house and then externally with potential customers while observing it in action, collecting feedback through 1-on-1 questioning, focus groups and/or surveys (in person, paper-based or online). As the offering approaches the so called minimally viable product, further market research and testing should be carried out including A/B testing to ensure a couple of options are kept open. At this point, exploring pricing may also be appropriate as well as potential export markets. Working through this Voice of the Customer (VOC) process in incremental steps, while minimizing any innovator bias, will ensure that your offering is developed with a strong understanding of your future customers and their market needs, This is the purpose as Steve Jobs is quoted above as saying, “What incredible benefits can we give to the customer.” Going to market without going through the appropriate research, development and market VOC steps risks the development of a “neat” product that won’t achieve the desired customer uptake. How many times have we seen a such a neat product or service advertised only to decide before (or even discover after the purchase), that it does not address our needs nor those of others resulting in a failure in the market. The Segway PT (personal transporter) “scooter” was one such product: very neat but not needed or wanted except in few niche markets. Obtaining the VOC is a critical activity that compliments your creativity as well as a strong understanding of: the technology developments in your industry, the intellectual property landscape, the competitive offerings and strategies, and the market size/potential. Together this knowledge will greatly improve your new offering’s probability of market success. As the new offering moves into the development stage, not only does the means of collecting information change, but additional customer groups need to be added depending on the type of innovation (See the Table). The additional information collected may allow a tweaking of the offering in order to address a larger market. For example, in the case of a radical innovation the customers of competitors should be added to the mix as they are currently satisfied, but may have unaddressed concerns. At this stage, you are ready to add some focus to the questioning. Initially developing simple and then more detailed storyboards and/or prototypes that outline the basic features and functions as a means to demonstrate the benefits and overall value, provide a vehicle for productive discussions to refine your understanding of the customer needs. Simple experiments designed to explore the various components or aspects of your offering, such as size, weight, material, speed, complexity, and/or user-friendliness are also appropriate. At this development phase, issues of price, cost to manufacture and even technical feasibility should be minimized so as not to overly bias the research process. As the questioning gets more specific, the sample size needs to get larger in order to ensure statistical significance. Again, care must be taken to ask indirect questions as this VOC process is designed to collect information, not sell preconceived ideas. Especially during this phase, you must be careful not to “invent in front of the customer.” If instead of asking questions, as to likes and dislikes, you and your customer start to brainstorm features together, your customer may have a legitimate and legal claim to be a co-inventor on a future patent filing! Finally, as the new offering approaches the market stage, more detail, specific and formal information collection from an even larger sample size, representing a broader range of customer groups is desirable (See the Table). At this stage, later versions of the offering could be tested in-house and then externally with potential customers while observing it in action, collecting feedback through 1-on-1 questioning, focus groups and/or surveys (in person, paper-based or online). As the offering approaches the so called minimally viable product, further market research and testing should be carried out including A/B testing to ensure a couple of options are kept open. At this point, exploring pricing may also be appropriate as well as potential export markets. Working through this Voice of the Customer (VOC) process in incremental steps, while minimizing any innovator bias, will ensure that your offering is developed with a strong understanding of your future customers and their market needs, This is the purpose as Steve Jobs is quoted above as saying, “What incredible benefits can we give to the customer.” Going to market without going through the appropriate research, development and market VOC steps risks the development of a “neat” product that won’t achieve the desired customer uptake. How many times have we seen a such a neat product or service advertised only to decide before (or even discover after the purchase), that it does not address our needs nor those of others resulting in a failure in the market. The Segway PT (personal transporter) “scooter” was one such product: very neat but not needed or wanted except in few niche markets. Obtaining the VOC is a critical activity that compliments your creativity as well as a strong understanding of: the technology developments in your industry, the intellectual property landscape, the competitive offerings and strategies, and the market size/potential. Together this knowledge will greatly improve your new offering’s probability of market success. - - - - - - - 1. http://www.smithsonianchannel.com/videos/how-lego-redefined-play/37021 2. https://en.wikipedia.org/wiki/History_of_Lego __________ “Listening to the Voice of the Customer” by Duncan Jones, Hexagon Innovating (2016) is licensed under CC BY-NC 4.0.

0 Comments

|

AuthorDuncan Jones Archives

June 2024

Categories |

||||||

RSS Feed

RSS Feed