|

As a mentor for The University of Toronto Faculty of Engineering’s Entrepreneurship Hatchery, I have the pleasure to assist students as they endeavour to develop their ideas into viable business opportunities. A key element of the Hatchery program is the monthly, 6-minute investor pitch that each team gives to their peers and the group of mentors. The subsequent audience questions and constructive criticism provides invaluable feedback that drives refinement of the pitches, the overall plans and the next steps. Having attended a number of pitch sessions as well as participating in these constructive criticism sessions, a number of common themes arise. I frequently have a desire for a deeper explanation of:

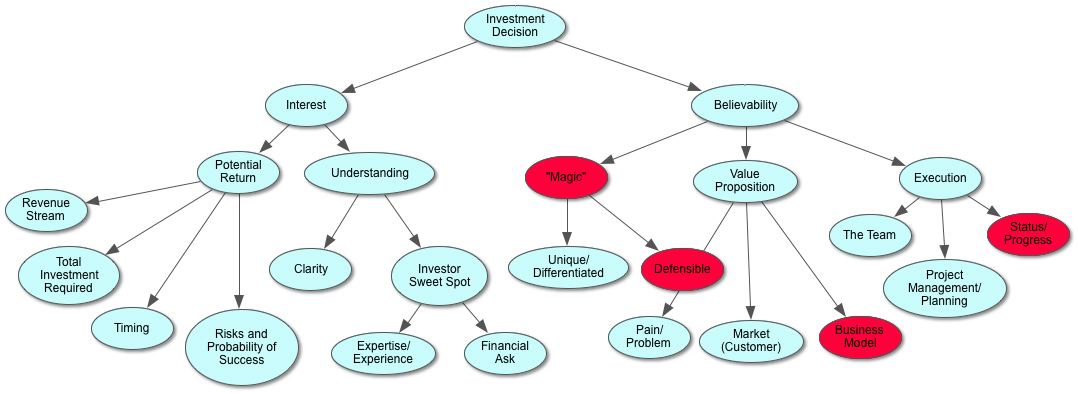

In thinking about all of the factors that go into a good pitch and the supporting business plan, I drafted the following set of relationships: L1: Investment Decision = f(Interest, Believability) The Investment Decision is a function of the Interest level and the degree of Believability. An investor must both be interested in the business opportunity, and its value and potential must be believable. L2: Interest = f(Potential Return, Understanding) The level of interest is a function of the potential returns as well as the investor’s understanding of the technology space and their own financial resources. L3: Potential Return = f(Revenue Stream, Total Investment Required, Timing, Risks and Probability of Success) In order to interest a potential investor, the potential return must justify the risks (i.e. a high risk opportunity must have the potential for very large returns). These potential returns can be calculated as the average annualized return on investment (ROI), as the risk-adjusted net present value (NPV) (i.e. applying a hurdle rate with a premium to account for the risks), or by applying a probability/decision tree to incorporate the main risks into ROI or standard NPV (i.e using a hurdle rate based on the cost-of-capital) calculations. As a result, a robust financial model needs to be developed for each opportunity and all efforts to reduce the the risks be they strategic, technical, commercial, financial or operational need to be taken. Planning, R&D, patenting, market and competitive research, cashflow management and project management are, respectively, activities that reduce risk (and improve the Believability). L3: Understanding = f(Clarity, Investor’s Sweet Spot) The second key component of Interest involves an investor’s level of understanding of the opportunity which is comprised of two components: Clarity and the Investor’s Sweet Spot. Clarity is associated with how well the opportunity is presented: the pitch, the story, the slide deck, the business plan and the supporting documentation. The frequent pitching and feedback at the Hatchery goes a long way to improving the clarity. L4: Investor’s Sweet Spot = f(Expertise/Experience, Financial Ask) The Investor's Sweet Spot, which is a function of the Expertise/Experience of the potential investor as well as the Financial Ask, unlike all the other factors are external ones. They cannot be improved upon directly by the entrepreneurial team’s efforts. As far as Expertise/Experience go, no matter how promising an opportunity is, it is unlikely that an investor will invest outside their comfort zone i.e. an area that they have some background knowledge or experience in. Every investor, whether friends and family, a solo wealth “angel” or a manager of a venture capital firm, operates within financial boundaries. Deals that are too large or too small relative to the size of the fund or funds available will not be of interest. The best strategy for the entrepreneur is, through research, to make best efforts to pitch to individuals and groups whose sweet spot matches both the type and stage of the opportunity. A second strategy is to identify a lead investor with the requisite experience/expertise and leverage them to build a syndicate of other investors who may not have quite the same level of expertise/experience but trust the leads’ assessment and who together can supply the required investment. This is quite a common practice at both the angel network and venture capital levels as it also allows these investors to diversify their investment portfolio. L2: Believability = f(“Magic”, Value Proposition, Execution) In addition to strong investor interest, the value and potential of the opportunity must be believable. Many opportunities will fit an investor’s sweet spot and are forecast to generate the desired returns, but often come up short on just one or more aspects that raise questions about the overall believability. Believability is a function of the underlying “Magic,” the Value Proposition and the Execution. L3: “Magic” = f(Unique/Differentiated, Defensible) The “Magic” is that unique WOW factor of the opportunity that makes it unique and differentiated from everything that’s gone before (See No Magic = No Opportunity). Apple’s magic has always involved user interface and design, Google’s was search based on web page ranking, in addition to keywords, to improve relevance. eBay brought auctions online. Amazon started as an online bookstore/broker providing an almost unlimited warehouse. Uber, Airbnb and now many others facilitate peer to peer transactions for services were excess capacity exists. In addition, the “Magic” must be defensible. The most common means including intellectual property protection, control over unique or limited resources including suppliers, scale, and customer lock-in or brand loyalty. Early stage companies tend to rely on know how, patents and exclusive arrangements, whereas more mature or fast growing companies can also leverage scale, brand loyalty and network effects as all of the previous examples have. L3: Value Proposition = f(Pain/Problem, Market (Customers), Business Model) The Value Proposition is a clear statement that describes the value or benefit you provide and how you capture that value. In order to create value, there must be a significant pain or problem among your potential customers that your product, service or business model significantly reduces. (The alternate but equivalent view is to create value by realizing an opportunity.) In the case of Airbnb, the pain is expensive hotels (or the opportunity is cheaper accommodations). This pain/problem must be shared by enough potential customers and at the same time not be adequately addressed by other competitive offerings i.e. there is an identifiable market. And finally, there must be a business model that captures this value in a win-win manner for the customer and your enterprise as well as any other stakeholders. Some common business models include: the low-cost provider through scale and efficiency like Walmart and McDonald’s; the direct sales model like Dell computer, Avon and Mary Kay Cosmetics, and Tesla electric cars; the franchise model like McDonald’s; the Subscription model like that of newspapers and magazines, and the popular advertising model used by Google and TV broadcasters. L3: Execution = f(The Team, Project Management/Planning, Status/Progress) With a strong value proposition based on a unique and defensible offering, the final component of believability relates to whether the assembled team can execute. When evaluating the team as well as the network of advisors, collaborators and suppliers, potential investors expect to see a collection of individuals with domain expertise covering all aspects of the technology, relevant business skills and experience, and of course leadership. Detailed plans, and processes to track and update the plans are a second indicator that the team will be able to execute while minimizing false starts and sidestepping traps. Although opportunities never evolve as outlined in the original business plan, a plan provides a foundation to guide current activities and can be amended as necessary when new information is generated or acquired. The final component of Execution concerns the current Status and Progress to date. Has the product been prototyped? Has the app even been wireframed? Has the major technical hurdle been overcome? Have critical component suppliers been secured? Has a regulatory hurdle been met? How extensive is the voice of the customer (VOC) research? Have distributors signed-on? Have initial sales been made? Are unit sales and revenues growing? These are just a few of the possible milestones that demonstrate progress, reduce risk and support believability in the opportunity. In summary, these nine functions and 23 components provide a means to evaluate an opportunity’s investment potential, as well as a guide as to the issues that should be addressed in the team’s investor pitch and related business plans. - - - In a previous slide deck entitled the “Six Tenets of Hexagon Innovating”, a framework is described upon which a business plan can be constructed or an opportunity analyzed. This six component framework includes an additional 12 sub-components. In the following two tables, this “Six Tenets” framework is compared to these nine functions and their respective components. These two models, although structured much differently, have a strong correlation and thus both cover the major aspects of innovative business opportunities.

2 Comments

|

AuthorDuncan Jones Archives

June 2024

Categories |

RSS Feed

RSS Feed