|

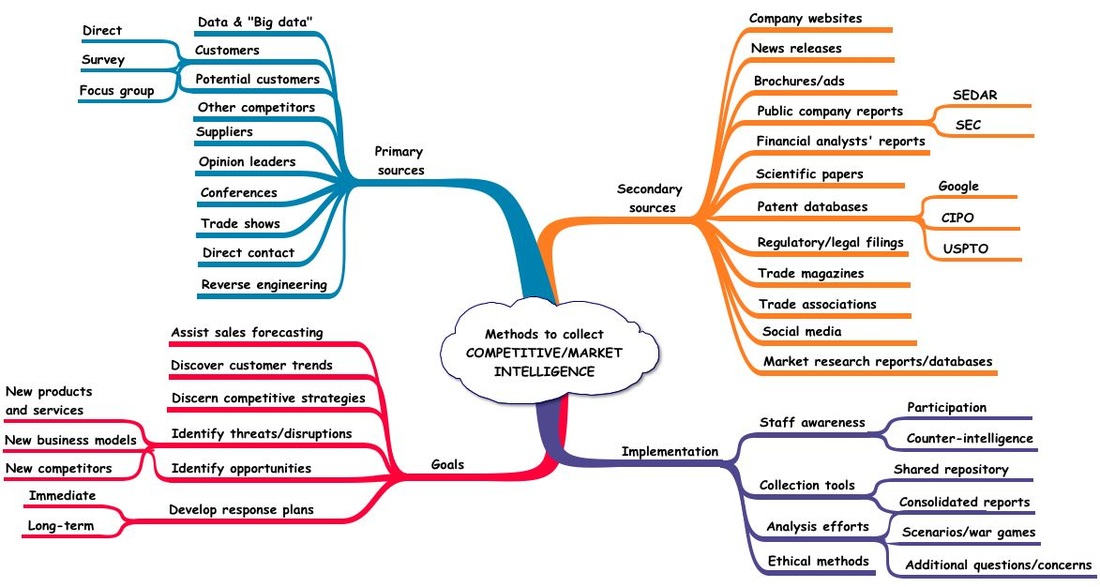

Environmental scanning incorporates the related disciplines of competitive intelligence (CI) and market intelligence (MI). It is an activity that is critical to a firm’s survival. Nevertheless, many firms approach environmental scanning in an adhoc as opposed to systematic way sometimes at their own peril. Firms need to develop and then maintain a good understanding of their direct competitors as well as potential and lateral competitors (think of how the internet challenges TV manufacturers). They also need to follow the relentless changes occurring in the marketplace including incremental as well disruptive changes arising from new offerings, customer preferences, and macroeconomic factors (STEEPLE). The goal of an intelligence project or ongoing scanning is usually to identify threats and then develop appropriate responses, however this knowledge can also be used to identify opportunities to pursue. Competitive and market intelligence is obtained by tapping into the wide range of secondary (as in secondhand) sources in conjunction with primary or direct sources. In order to ensure the intelligence is accurate, it is best if it can be corroborated by additional independent sources. Since firms need to frequently communicate with their customers as well as other stakeholders including investors, regulators and suppliers, a lot of information is available. Secondary sources, primarily accessible through the internet, include company websites, financial reports, patent filings and regulatory filings. Primary sources include a firm’s own internal sales funnel data as well as information obtained from conversations with customers, opinion leaders and even directly with competitors. Given the limited amount of time there is to speak with these people, it is important be familiar with all the secondary information and develop a list of key questions. An important point is that all intelligence collection must be done ethically. No one wants their firm’s name on the front page of the newspaper for stealing, bribery or putting a competitor’s employee in an awkward position. Developing a robust intelligence capacity requires broad employee involvement, shared collection tools and a focus on analysis. CI guru Ben Gilad once said that a company’s employees already possess 80% of the information you want to know. They google, read, attend conferences, and speak with customers, suppliers, regulators and even competitors. The challenge is to collect, consolidate and analyse this mainly tacit knowledge. This can be achieved by raising their CI/MI awareness and encouraging active participation. It can be facilitated by collection tools such as a shared database, internal reports and CI/MI meetings or agenda items. Conversely, company employees also know a lot about their own firm and need to be coached in counter-intelligence so they aren’t offering up valuable information to other CI practitioners. What really separates adhoc from systematic environmental scanning, aside from the increased effort, is a focused effort. Collecting reams of data is easy, but distilling actionable intelligence from it is the key. This requires not only detailed analysis but also the raising of key questions and uncovering their answers. It is a key question if it drives a decision tree with each possible answer resulting in the company responding in a different manner. Example: A report comes out about a new battery technology that promises a significant improvement in energy density (joules/gram). Two keys questions might be: Will the cost be comparable to existing batteries or much higher? and Will this new battery be commercially available soon or at least a few years out? Learning that this battery will be available soon, at a reasonable price could drive licensing or acquisition activities. Learning that commercialization is imminent but at a much higher cost could drive a price cut on the existing battery to improve its value proposition. Whereas learning that commercialization will likely be far off in the future at a unknown price leads to a third question: Will this technology eventually be disruptive? The answer to which could drive either a wait-and-see approach, the ramping up internal research and development, or the forming of a research collaboration with the inventors. References: https://www.marketingsherpa.com/article/how-to/5-tactics-to-research-your http://www.slideshare.net/RobbySahoo/competitive-intelligence-11967702 https://www.scip.org http://www.academyci.com/benjamin-gilad/ http://www.fuld.com/what-is-competitive-intelligence http://www.inc.com/magazine/20110401/how-to-use-competitive-intelligence-to-gain-an-advantage.html http://competia.com/50-competitive-intelligence-analysis-techniques

0 Comments

|

AuthorDuncan Jones Archives

June 2024

Categories |

RSS Feed

RSS Feed